“Too many founders build their pitch around what they care about, not what the investor cares about. The real question every investor asks is simple: why should I care?

The best fundraising stories answer that question clearly — by aligning vision with market reality and showing how your success becomes theirs.”

David Wu

David Wu is a British-Chinese entrepreneur dedicated to scaling transformative technologies into global successes. He is both President of Ascent Funds where he drives investments in next-generation energy tech and CEO of Incepto Global, where he advises visionary founders across Asia and the Middle East, delivering proven strategies for guiding companies from seed stage to public markets.

With over 20 successful IPOs, David’s career spans high-impact roles in banking, corporate and government. After graduating from Cambridge University, David began his career with Rothschild in London, Moscow and Singapore, where he specialized in IPO execution before shaping strategic IPO narratives at Brunswick Group in Beijing and Edelman in Hong Kong. David then ran Capital Markets for InterOil Corp in New York where he orchestrated its $2.5 billion sale to ExxonMobil and later for Fosun International, China’s largest investment conglomerate managing over US$100 billion in assets.

Since founding Incepto Global, David has advised on landmark deals, including launching Saudi Arabia’s PIF-backed $100 billion advanced manufacturing platform and taking Asia’s luxury fashion leader Lanvin Group public on the NYSE.

David is based in Singapore and Riyadh.

“Thoughts” by David Wu

-

The tools America REALLY doesn't want China to have

September’s Blackstone Investment Symposium was not just another Wall Street gathering—it was the epicenter of strategic thinking for one of the globe’s largest asset managers, with $1.2 trillion under management. That scale commands attention: Blackstone is a bellwether for how capital is being deployed in the new digital age. “If the US wants to win the AI race, it must control three pillars—chips, datacenters, and power.”

-

What should we be teaching out kids?

Let’s be honest: no one really knows what their kid should be doing anymore— certainly not in Singapore, not anywhere. Coding? The pundits say AI’s got that covered, and now we’re fretting our kids are just training future overlords in Python. Robotics? Apparently, assembling parts is only fun until you realise the robot you built is also going to take your job.

-

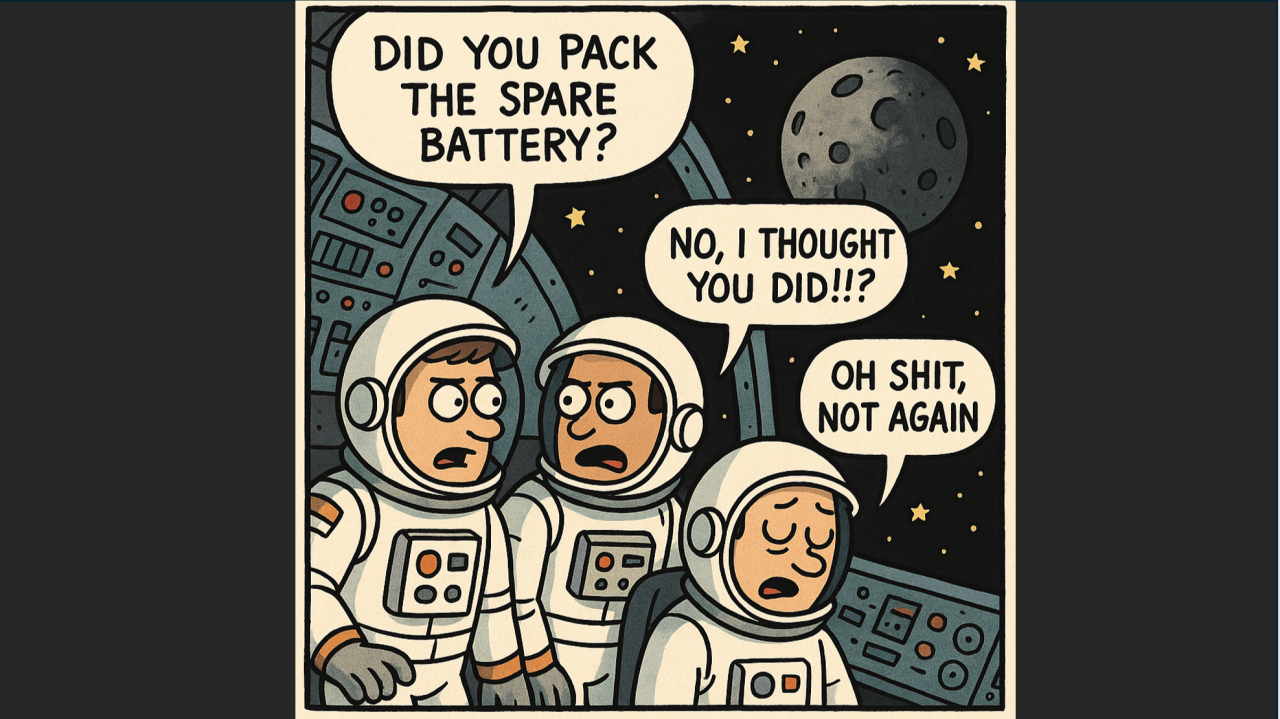

to battery or not to battery

When it comes to satellites, the battery isn’t just ‘another component’ —it’s the lifeblood that keeps our eyes, ears, and shields in the sky running. A simple failure up there doesn’t mean a missed phone call; it can mean millions lost, defense capabilities compromised, and data streams going dark over half the planet.

-

How did it go so wrong with Hydrogen

If 2025 means anything for hydrogen, it’s that perfectionism and politics suffocated real progress—at least in the West. While governments in the US, Europe, and Australia argued over “rainbow colours”, China quietly tore up the playbook and is now rewriting hydrogen’s future on its own terms.

-

this is a gamechanger

Forge Nano, Inc., a technology company pioneering domestic battery and semiconductor innovations, today announced the successful close of $40 million in new funding. The funding was co-led by RockCreek, and Ascent Funds.

-

our own energy theory

The world is barreling toward a supply crisis. In this Real Conversation with Keith McCullough, Mark Gordon, co-founder of Ascent Funds, will diagnose the issues within this current dynamic and propose a better path forward.